Hopkins is a coastal village in southern Belize known for its pristine beaches and Garifuna cultural heritage. This report examines the real estate market in the Hopkins area (specifically within 100 meters of the beach) focusing on residential and commercial properties (land and houses). We analyze historical trends from 2015–2025, including price movements, supply and demand shifts, buyer profiles, and notable developments. We also project market trends for 2025–2035, assessing expected growth or decline, potential risks, and emerging opportunities. Both investment considerations (such as rental yields and appreciation potential) and retirement/lifestyle factors (such as community and quality of life) are discussed. All prices are in USD.

Historical Trends (2015–2025)

Market Growth and Price Trends (2015–2020)

In the mid-2010s, Hopkins was a relatively “sleepier” market compared to larger Belize destinations, with fewer developments and modest prices (Placencia Vs Hopkins – How To Choose Between Them For Your Trip To Belize! — Remax VIP Belize). Beachfront lots in Hopkins (e.g. Sittee Point subdivisions) could be found around the ~$100,000 range in 2015, reflecting the village’s still-emerging status. Demand during this period was steadily rising, driven largely by foreign buyers seeking affordable Caribbean property. Belize’s tourism boom in the late 2010s had a direct impact on Hopkins: the country saw double-digit increases in tourist visits by 2018, which fueled demand for vacation rentals and prompted more people to consider retiring in Belize (The Belize Real Estate Market in 2018 | Buy Belize). As Belize gained popularity relative to more crowded markets like Costa Rica or Mexico, real estate interest intensified, and prices began to climb. By 2018, Belize’s real estate market was described as “red hot,” with many investors and expats drawn by the low cost of living and attractive scenery (The Belize Real Estate Market in 2018 | Buy Belize). In Hopkins, this translated to increased competition for beachfront properties and a noticeable uptick in property values around 2018–2019.

Supply and development also started expanding in this era. Early in the period, Hopkins had only a handful of small resorts and expat homes, but by the late 2010s new subdivisions and projects were underway. For example, additional phases of the Sittee Point Estates (south of Hopkins Village) were opened for sale. A listing in late 2017/2018 advertised one of the last remaining beachfront lots in Sittee Point Phase 2 for about $175,000 (Belize Beachfront Lots for Sale Phase 2 – Caribbean Sea Views), suggesting that prime seafront land in Hopkins had already appreciated into the mid-six figures by that time. Local real estate agencies reported strong foreign buyer interest, noting that many buyers were from the U.S. and Canada, attracted by Belize’s English-speaking environment and ease of ownership (Belizean Real Estate Market Trends and Mortgage Rates – Hopkins Belize Travel). Importantly, Belize imposes no restrictions on foreign property ownership, even for lucrative beachfront land (Belize Residential Property Market Analysis 2024). This permissive legal climate encouraged international investment in areas like Hopkins throughout the 2015–2020 period.

Late 2010s to 2025: Demand Surge and Price Acceleration

By the early 2020s, the Hopkins real estate market experienced a sharp acceleration in both demand and prices. Several factors contributed to this surge. First, retirees and expatriates continued to relocate to Belize for its relaxed lifestyle and climate, many choosing Hopkins for a more authentic village atmosphere. The Belize Tourism Board noted that smaller coastal villages were seeing growing interest from expats integrating into the community (Belize Real Estate Investment Trends 2021) (Belize Real Estate Investment Trends 2021). Second, investors began targeting Hopkins for its rental income potential, seeing an opportunity in the rising tourism numbers. Even during the global disruptions of 2020, Belize’s real estate market remained resilient – the country’s sensible public health measures allowed tourism to rebound relatively quickly (Belize Real Estate Investment Trends 2021). By 2021, the market was still “unsaturated” with ample opportunities, but consumer demand was high, especially in waterfront areas (Belize Real Estate Investment Trends 2021). Essentially, the supply of desirable beachfront homes and land remained limited in Hopkins, while the pool of buyers (both investors and lifestyle buyers) kept growing, putting upward pressure on prices.

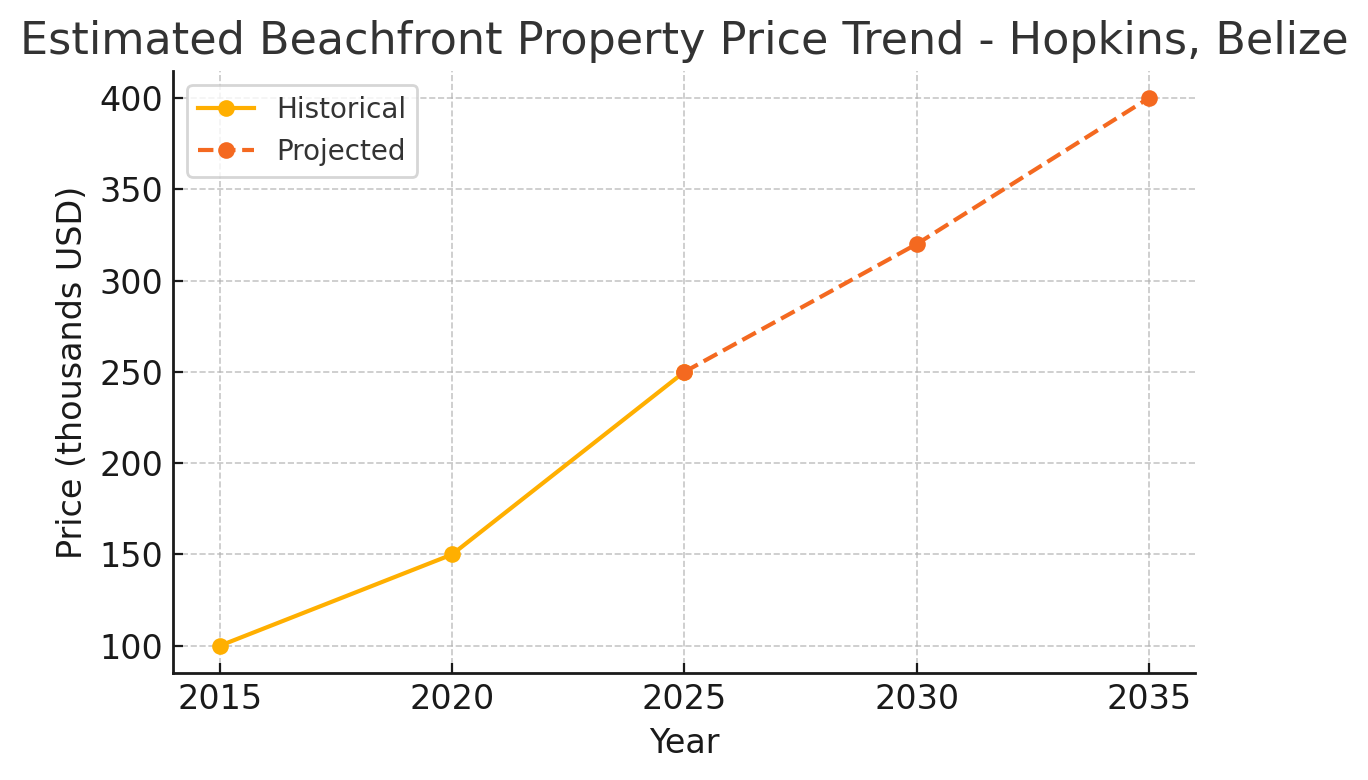

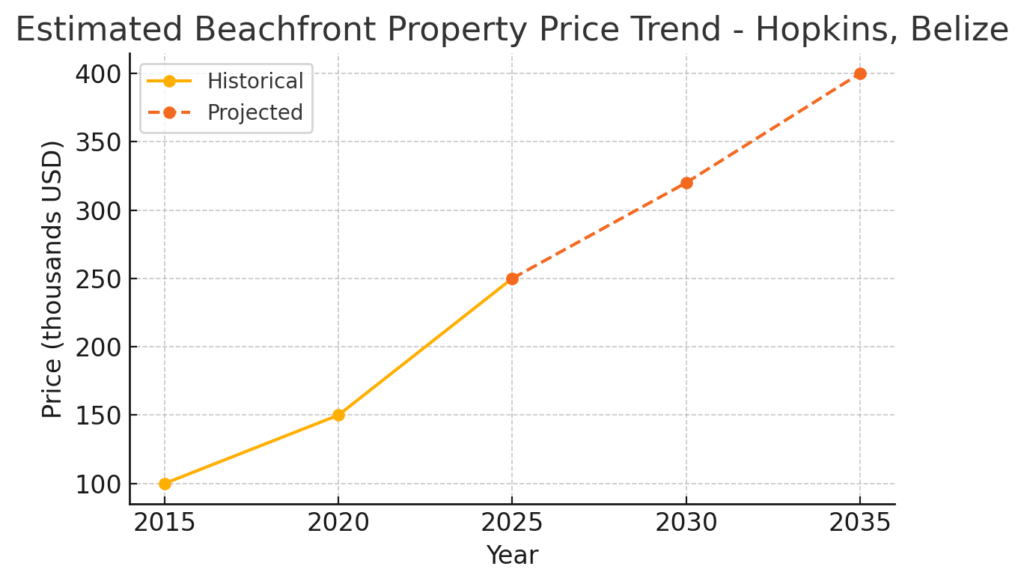

From roughly 2020 to 2025, local agents and observers report that prices for beachfront properties have risen dramatically. In some parts of southern Belize, beachfront property values roughly doubled between 2020 and 2023 (Current Real Estate Environment : r/Belize). In Hopkins specifically, an upward price trend was evident through 2023, supported by steady foreign demand and a hot post-pandemic market (Belizean Real Estate Market Trends and Mortgage Rates – Hopkins Belize Travel). For example, by 2023–2024 a typical vacant beachfront lot in a Hopkins gated community (with ~75 feet of seafront) was listed around $200–$250K (Belize Real Estate), up from closer to ~$100K a decade prior. Finished beachfront homes likewise saw appreciation: a simple 2-bedroom beach house that might have sold for around $200K in the mid-2010s could fetch on the order of $400K or more by 2025, depending on size and amenities (Property for Sale in Hopkins, Stann Creek District – realtor.com) (Property for Sale in Hopkins, Stann Creek District – realtor.com). This growth reflects both value appreciation and new construction of higher-end properties. A local 2023 market review noted that $150,000 could even buy a home just minutes from the beach in some parts of Belize (2023 Could Be A Pivotal Year for Real Estate in Belize. Here’s Why.) – underscoring that while prices have risen, Belize (and Hopkins) still offer relative bargains compared to other Caribbean locales.

(image) Figure: Estimated Beachfront Property Price Trend in Hopkins (2015–2025) with Projection to 2035. Prices (in thousands of USD) have trended upward from the mid-2010s through 2025 as demand grew (The Belize Real Estate Market in 2018 | Buy Belize) (Belize Real Estate). The dashed line suggests a potential continued growth trajectory through 2035, assuming sustained demand. Actual future values will depend on market conditions.

Notable Developments and Supply Changes

Several notable developments in the Hopkins area over the past 10 years have both responded to and further stimulated the market growth. In the late 2010s, new hospitality and residential projects began to dot the shoreline. For instance, the Hopkins Bay Resort (a collection of villa-style residences operating as a resort) expanded operations, and boutique resorts like Almond Beach and Jaguar Reef Lodge attracted more visitors to Hopkins. By 2022, developers were launching upscale projects to cater to growing demand. A prime example is The Belize Collection’s luxury villas at Jaguar Reef, announced in 2022 – a set of 12 high-end beachfront condo-villas at the south end of Hopkins (Belize Collection To Launch New Luxury Villas In The Jewel Of The Caribbean – Travel Noire) (Belize Collection To Launch New Luxury Villas In The Jewel Of The Caribbean – Travel Noire). These villas, each with two bedrooms and private plunge pools, were offered as turnkey vacation residences that buyers can own and place into the rental pool. The resort’s parent company explicitly noted that “with Belize’s real estate market booming, these residences are an incredible investment opportunity” (Belize Collection To Launch New Luxury Villas In The Jewel Of The Caribbean – Travel Noire). This marked a significant upscale addition to Hopkins’ property offerings and highlights how developers in the early 2020s targeted higher-end investors and second-home buyers.

On the land development side, the inventory of beachfront lots in and around Hopkins has been steadily absorbed. Early subdivisions near the village (Sittee Point Phases 1–3) largely sold out by the mid-2010s. In response, new phases opened further south in an area often called False Sittee Point (about 3 miles from Hopkins). Phase 4 of this estate, opened around 2019–2020, offered a handful of large sea-front parcels (some paired with lagoon-side lots) aimed at both residential and commercial buyers. By 2024, 8 of 9 Phase 4 seafront lots had sold – with the last available lot listed at $435,000 (this lot included dual frontage on the Caribbean Sea and a canal) (Belize Real Estate). Similarly, Phase 5 lots (in a gated community near the Sittee River mouth) were on the market in the mid-$200K range and quickly attracting buyers (Belize Real Estate). These rapid sell-outs indicate how tight the supply of quality beachfront land has become. The table below highlights a timeline of key developments and market moments in Hopkins from 2015–2025:

| Year | Market Highlights – Hopkins Beach Area |

| 2015 | Hopkins is a quiet village with few expat homes; beachfront lots ~$100K; first hints of growing international interest. |

| 2018 | Belize tourism surges (+10% YoY arrivals) fueling real estate demand ([The Belize Real Estate Market in 2018 |

| 2020 | COVID-19 pause: Tourism briefly stalls, but many buyers hold interest. Market remains unsaturated with high demand once travel resumes (Belize Real Estate Investment Trends 2021) (Belize Real Estate Investment Trends 2021). |

| 2022 | Market rebounds strongly. Jaguar Reef Villas (12 luxury condos) launched, tapping into a “booming” market (Belize Collection To Launch New Luxury Villas In The Jewel Of The Caribbean – Travel Noire). Beachfront lot prices ~$180–200K. |

| 2023 | Record foreign interest in Hopkins. Prices continue upward with demand outstripping supply (Belizean Real Estate Market Trends and Mortgage Rates – Hopkins Belize Travel). Many beach properties see values ~2× 2020 levels. |

| 2025 | Limited beachfront inventory; new projects underway (e.g. 60-acre Mangrove Resort Phase 2) to add homes and a marina (Mangrove Resort & Marina) (Mangrove Resort & Marina). Beachfront lots ~$225K+. |

In summary, 2015–2025 was a decade of robust growth for Hopkins real estate, especially for properties near the beach. Prices rose significantly, and the market evolved from a niche expat hideaway to a more internationally recognized destination. By 2025, Hopkins boasts a mix of local charm and new upscale developments, with a diverse array of buyers – from retirees seeking a tranquil seaside lifestyle to investors developing boutique rentals – all drawn to the area’s “untapped potential” and rising prominence (Belize Real Estate: Invest in a Growing Market with Untapped Potential).

Market Outlook 2025–2035 (Projections)

Growth Projections and Demand Drivers

Looking ahead, most indicators point to continued growth in the Hopkins real estate market over the next 10 years, though perhaps at a moderated pace compared to the last few years. Tourism forecasts for Belize are very optimistic, which bodes well for coastal real estate. Over the next 15 years, Belize’s overnight tourist arrivals are expected to triple, and the government is planning major infrastructure expansions (including new international airports) to support this influx (Will Belize Be Getting More Airports? Aviation Sector to be Expanded). Hopkins is well-positioned to benefit from these trends: it lies between two key hubs (Dangriga and Placencia) and could see increased visitor traffic if the planned Placencia International Airport becomes operational in the coming years. More tourists would mean greater demand for vacation rentals and services in Hopkins, enhancing the appeal of owning property in the area for rental income.

On the demand side, international interest remains strong. The demographic wave of Baby Boomer and Gen X retirees from North America is expected to continue through the 2020s. Belize’s ongoing reputation as a top retirement haven (even featured in Forbes’ “Best Places to Retire Abroad” (Belize Residential Property Market Analysis 2024)) will keep Hopkins on the radar of those seeking a seaside retirement. Additionally, emerging segments like digital nomads and remote workers add to future demand. Belize introduced a Digital Nomad program in 2022, which has started to attract remote professionals to spend extended periods in-country (7 emerging trends and their opportunities in Belize Real Estate for 2025 | New Dawn Realty). Coastal villages like Hopkins – with their laid-back lifestyle and natural beauty – may draw some of these long-term visitors as renters or even buyers, especially as internet connectivity improves (Hopkins now has fiber-optic internet available in many areas).

Property values are therefore likely to trend upward through 2035, although perhaps not as steeply as the immediate pre-2025 period which saw a post-pandemic surge. Assuming a healthy but moderate growth rate, one could expect beachfront land and home prices to increase by a few percent annually. As a illustration, if a prime beachfront lot is ~$250K in 2025, it might reach on the order of $350K–$400K by 2030–2035, given sustained demand. In the previous chart, we projected a potential trajectory (dashed line) that shows values continuing to rise through 2035. This is supported by the fact that Belize’s real estate market fundamentals remain strong – the country offers relative affordability and high quality of life, which should continue to attract buyers. Many experts note that those who bought Belizean property 10–20 years ago have seen “handsome” returns, and the mid-2020s could offer a similar window of opportunity (2023 Could Be A Pivotal Year for Real Estate in Belize. Here’s Why.).

Another growth driver is the pipeline of planned developments in the Hopkins region. The next decade will likely see completion of large projects such as the Mangrove Resort & Marina, a 60-acre master development at the south end of Hopkins (Phase 2 currently underway) featuring oceanfront home lots, a 42-slip marina, and resort facilities (Mangrove Resort & Marina) (Mangrove Resort & Marina). This project, when fully realized, will elevate Hopkins’ profile and could stimulate improvements in local infrastructure (roads, utilities) as well as increase property values in the vicinity. We may also see additional boutique resorts or gated communities announced, as developers capitalize on Hopkins’ remaining parcels of undeveloped beachfront. Sustainable and eco-friendly projects are an emerging trend in Belize real estate (7 emerging trends and their opportunities in Belize Real Estate for 2025 | New Dawn Realty), so new developments might emphasize green building, which could attract environmentally conscious buyers. Overall, the outlook for supply is that while new properties will come online, the scale of development in Hopkins is likely to remain boutique (no high-rise condos or massive hotel strips), preserving a balance between growth and the village’s intimate character. This controlled growth should help sustain property values over time, avoiding the oversupply risk seen in some overbuilt markets.

Potential Risks and Challenges

No projection would be complete without considering the potential risks and challenges that could affect the market trajectory. One of the foremost concerns in coastal Belize is the risk of hurricanes and climate-related impacts. Hopkins, being right on the Caribbean, faces “consistent risk during the Atlantic hurricane season (June–Nov)” each year (Belize Residential Property Market Analysis 2024). A major storm strike could temporarily disrupt the market – damaging properties, increasing insurance costs, or necessitating new building code measures. Rising sea levels and beach erosion over the next decade are also factors to watch; properties within 100m of the beach are by nature exposed. Investors and homeowners will want to mitigate these risks by building resilient structures (concrete foundations, elevated designs) and carrying adequate insurance. The Belize government’s focus on environmental sustainability and disaster preparedness will be crucial in maintaining investor confidence in coastal real estate.

Another challenge is the global economic climate. The Hopkins market is heavily driven by foreign capital; if the U.S. or Canadian economy enters a recession or if interest rates remain high, some potential buyers might delay international property purchases. For instance, in 2022 the U.S. saw a housing market shift due to rising mortgage rates (2023 Could Be A Pivotal Year for Real Estate in Belize. Here’s Why.). While Belize is often a cash market (many foreign buyers purchase without financing), a downturn in investors’ home countries could soften demand. That said, Belize has historically been somewhat insulated from short-term swings – those committed to a retirement or relocation often have a long-term horizon. It’s also worth noting that Belize’s currency is pegged to the U.S. dollar, providing monetary stability, and that Belize imposes no capital gains tax on property sales and very low property taxes (Hopkins Village, Belize | What do I need to know when buying property in Hopkins Village? | Expat Exchange). These factors can continue to attract investors even if other markets wobble.

A specific risk in the Belize real estate scene has been the presence of the occasional fraudulent development scheme. A cautionary tale was the infamous Sanctuary Belize project (located south of Hopkins), which was marketed in the 2010s as a luxury community but turned out to be a fraud – the developers failed to deliver promised infrastructure, and many buyers lost money, unable to resell their lots (FTC Sending Refunds to Consumers who Invested in Deceptive Sanctuary Belize Real Estate Development Scheme Operated by Repeat Offender Andris Pukke | Federal Trade Commission) (FTC Sending Refunds to Consumers who Invested in Deceptive Sanctuary Belize Real Estate Development Scheme Operated by Repeat Offender Andris Pukke | Federal Trade Commission). In 2018, a U.S. court halted this scam, and in 2023 the FTC arranged refunds to defrauded investors (FTC Sending Refunds to Consumers who Invested in Deceptive Sanctuary Belize Real Estate Development Scheme Operated by Repeat Offender Andris Pukke | Federal Trade Commission). The lesson for the 2025–2035 outlook is that due diligence is essential. Prospective buyers should work with reputable local realtors and attorneys, verify titles, and be cautious of deals that seem too good to be true. Fortunately, the Belize government has become more vigilant, and established firms in Hopkins (often franchises of international brands or longstanding local brokers) have solid track records. Still, maintaining investor trust will require transparency and reliability in new developments. The presence of successful projects (like the Hopkins Bay community or Jaguar Reef condos) will help in this regard, showing that many developments do deliver as promised.

In summary, while the overall outlook is positive, buyers and investors in Hopkins should keep an eye on weather risks, global economic conditions, and ensure they engage in safe buying practices. None of these challenges are expected to reverse the growth trend, but they could influence the pace of growth or the type of properties that prosper (e.g. well-built homes may command a premium for storm safety, etc.).

Emerging Opportunities

The coming decade also brings several new opportunities in the Hopkins area real estate market. One notable opportunity lies in the rental market, which is expected to grow alongside tourism. Investors who purchase in Hopkins can benefit from strong vacation rental demand, especially for beachfront villas and homes. Belize’s short-term rental yields are attractive – estimates put rental returns at about 8–10% (and up to 15% in prime spots) for vacation properties (Belize: A Prime Destination for Real Estate Investment). As Hopkins gains more notoriety as a cultural and adventure destination (nearby attractions include the Belize Barrier Reef, Cockscomb Basin Wildlife Sanctuary, and Mayflower Bocawina park), demand from tourists seeking a home-base in Hopkins should rise. This opens opportunities for hybrid use properties: owners can enjoy part-time use of their beach home and rent it out the rest of the year, effectively offsetting costs. The ongoing expansion of platforms like Airbnb and the continued preference of many travelers for private beach houses bode well for this strategy. In fact, investors are increasingly targeting land in Hopkins to build custom vacation homes to meet this demand (7 emerging trends and their opportunities in Belize Real Estate for 2025 | New Dawn Realty).

Another opportunity is in catering to the retirement and second-home market. As more people choose Hopkins for its lifestyle, services catering to an older expatriate population will be in demand – think medical clinics, property management services, and community activities. A commercial real estate investor might find opportunity in developing a small wellness center or co-working cafe in the village to serve the growing expat community. On the residential side, there is potential in second-row properties just off the beach (within 100m but not direct beachfront). These can be more affordable yet still offer beach access, appealing to retirees on a budget. With beachfront values climbing, some buyers will seek homes a short walk from the sea at lower price points, which could invigorate the market for properties slightly inland (still within the 100m band or just beyond).

Lastly, Hopkins could see an upswing in eco-conscious development, turning the area’s natural strengths into opportunities. For example, solar-powered homes and rainwater harvesting systems are becoming popular among new builds, aligning with global green trends (7 emerging trends and their opportunities in Belize Real Estate for 2025 | New Dawn Realty). A developer focusing on sustainable, low-impact beachfront cottages might tap into a niche of buyers looking for an “eco-retreat” vibe. Similarly, maintaining the authentic charm of Hopkins is itself an opportunity – the village’s rustic, friendly character is a selling point that differentiates it from more commercialized destinations. Entrepreneurs who invest in local businesses (fishing tours, Garifuna cultural experiences, farm-to-table dining, etc.) not only enhance the tourism appeal but also indirectly boost real estate values by making Hopkins a more attractive place to live or own a vacation home.

In conclusion, the period 2025–2035 is expected to be one of steady growth and diversification for Hopkins real estate. Barring unforeseen shocks, property values should continue to appreciate, supported by rising demand from tourists, retirees, and investors alike. New infrastructure and developments will likely add value, while the community retains its unique charm. Savvy investors who understand both the investment potential and the lifestyle allure of Hopkins stand to benefit from the area’s next chapter.

Investment Outlook and Considerations

Purchasing property in Hopkins can be viewed through the lens of investment potential. Several factors make the area attractive to investors:

- Appreciation Potential: As detailed in the historical section, property values in Hopkins have shown strong appreciation over the past decade. This trend is expected to continue, albeit moderately. Buying in early on emerging developments or available beachfront lots could yield significant capital gains over the long term if market growth persists. Belize’s economic and political stability (the currency is fixed 2:1 to the US dollar and the country has a stable democracy) adds confidence that investments will not be undermined by volatility. Moreover, foreign direct investment in Belize has been growing – the Central Bank reported a 7% YoY increase in FDI in 2023, primarily in real estate and related sectors (Belize Residential Property Market Analysis 2024), indicating momentum and interest that investors can ride.

- Rental Income and Yields: Hopkins offers investors the chance to earn strong rental returns. Vacation rental yields in Belize can range from ~8% up to the low teens annually in top beachfront locations (Belize: A Prime Destination for Real Estate Investment). Hopkins’ mix of beachfront tranquility and cultural attractions makes it a compelling choice for tourists seeking alternatives to larger resorts, thereby keeping rental demand high. Many owners choose to rent their Hopkins property to short-term visitors when not using it, effectively turning their asset into an income generator. With tourism expected to grow, the rental market could become even more lucrative. It’s also worth noting that Belize has very landlord-friendly policies – there are minimal restrictions on vacation rentals, and platforms like Airbnb are widely used. Additionally, taxes on rental income are low (a 3% income tax on rental earnings) and property taxes are negligible (often just a few hundred dollars a year for residential properties) (Buying Real Estate in Belize) (Hopkins Village, Belize | What do I need to know when buying property in Hopkins Village? | Expat Exchange). This means investors get to keep most of their rental profits, enhancing net yield.

- Diversification and Safe Haven: Some investors view Belize real estate as a diversification play or a safe-haven asset. Property in Hopkins is a tangible dollar-denominated asset in a country with no capital gains tax and no estate tax (Buying Real Estate in Belize). For those with portfolios in volatile markets, owning a beach property in Belize provides geographic and financial diversification. It also doubles as a lifestyle investment – unlike stocks or bonds, a home or land in Hopkins can be enjoyed personally. During the COVID-19 pandemic, interest in Belize property actually grew among some investors seeking less densely populated, nature-rich locations for future resilience (Belize Real Estate Investment Trends 2021). This suggests that beyond pure financial motives, investing in a place like Hopkins can be part of a long-term personal plan (e.g., eventual retirement use) while still generating interim returns.

- Market Entry and Exit: The liquidity of real estate in Hopkins is improving as the market matures. Traditionally, one concern investing in a small foreign market is how easily you can sell when you need to. Over 2015–2025, liquidity has improved – more agencies (including international franchises like RE/MAX, Century21, etc.) operate in the area, and online listings on platforms such as Realtor.com and Belize MLS have increased transparency. Properties that are priced right and in desirable locations (beachfront or close to it) have been selling at a healthy pace; for instance, the quick sell-through of Phase 4 lots mentioned earlier demonstrates that there are active buyers waiting (Belize Real Estate). Going forward, if the expat population and tourism keep rising, the pool of potential buyers (both foreign and domestic) will grow, making it easier to find a buyer when an investor chooses to exit. Still, investors should plan for a longer holding period (real estate is not a quick-flip in Belize, despite some speculation in recent years). It’s wise to invest with a 5-10 year horizon to comfortably weather any market slowdowns and to capitalize on the projected growth.

- Risks for Investors: We’ve touched on risks in the projection section, but to reiterate investor-specific points: it’s crucial to ensure clear title and proper registration when buying (title insurance is available in Belize and can add peace of mind). Work with qualified local attorneys and reputable real estate agents – “the market is not regulated, so using a reputable agent or attorney is crucial,” as one expat advised (Hopkins Village, Belize | What do I need to know when buying property in Hopkins Village? | Expat Exchange). Also, consider insurance costs in your ROI calculations; hurricane insurance can add to holding costs, though property taxes are low. Another consideration is currency – Belize dollars are tied to USD, so currency risk for U.S. investors is minimal, but if you’re from elsewhere, factor in exchange rate considerations. Finally, while rental yields are good, investors should not assume full occupancy year-round; tourism has high and low seasons. A realistic approach is to calculate yields based on perhaps 60-70% annual occupancy for a well-marketed rental in Hopkins (peak seasons often see near 100% occupancy, and off-season much lower). Even with these caveats, the investment outlook is quite favorable.

In summary, Hopkins presents a compelling case for real estate investment: strong returns, growing demand, and a supportive environment for foreign investors (no ownership barriers, favorable taxes, and residency incentives). Diligence and a long-term perspective are key to maximizing these opportunities. Many who invest in Hopkins do so with a dual mindset – part investment, part personal enjoyment – which, when balanced correctly, can yield both financial rewards and an enriching tropical lifestyle.

Retirement and Lifestyle Appeal

Beyond numbers and returns, Hopkins holds a special appeal for retirees and lifestyle buyers looking to enjoy the Caribbean dream. In fact, the retirement/lifestyle aspect is intertwined with the market dynamics – a significant portion of buyers in Hopkins are motivated by the desire to live in paradise, not just invest. Here we discuss why Hopkins is attractive as a place to live or retire, and what considerations come with that decision.

- Authentic Village Life: Hopkins offers a blend of natural beauty and cultural richness that is hard to find elsewhere. It is often described as one of the more authentically Belizean beach communities. Unlike some resort towns, Hopkins remains first and foremost a traditional Garifuna village, known for its friendly locals, drumming and dance, and colorful fishing boats along the shore. For retirees seeking a laid-back life immersed in local culture, this is a huge draw. One expat comparison noted that “Hopkins is a more rustic, sleepier village… if you are looking for warm interactions with locals, where the experience IS the village (no chain stores, all local restaurants), then Hopkins delivers” (Placencia Vs Hopkins – How To Choose Between Them For Your Trip To Belize! — Remax VIP Belize). At the same time, it has just enough expat presence and tourism that you’ll find several comfortable amenities – a variety of restaurants and beach bars, small grocery shops, and tour operators – meaning you won’t feel isolated or lacking things to do. The vibe is very relaxed: days in Hopkins might involve a morning swim in the sea, an afternoon bike ride through town, and an evening enjoying live Garifuna music under the stars. This slower pace of life, set to the rhythm of the sea, is exactly what many retirees are looking for.

- Climate and Environment: Hopkins’ tropical climate is a major reason people retire here. Warm temperatures year-round (averaging around 80°F/27°C) and coastal breezes make for a pleasant environment, especially for those escaping cold winters up north. Outdoor enthusiasts have a playground at their doorstep – the Belize Barrier Reef (for fishing, snorkeling, diving) is a short boat ride away, and inland rainforests and waterfalls are within an hour’s drive. Staying active is easy when you can kayak in the lagoon or take long walks on a 5-mile stretch of beach. Retirees often cite health benefits to this lifestyle: more time outdoors, fresh seafood in the diet, and a generally less stressful environment. Do keep in mind the tropical humidity and bugs (sandflies can be pesky at dusk) – living in the tropics requires some adaptation and proper home screening, but most expats take these in stride as part of life in paradise.

- Community and Expat Support: Over the past decade, a small but tight-knit expat community has developed in Hopkins and the surrounding Sittee Point area. This community provides a support network for newcomers figuring out life in Belize. From informal meet-ups at local cafes to volunteer projects (like community clean-ups or school support), there are ways to get involved and make friends. English being the official language makes integration much easier – everyday tasks like banking, shopping, or chatting with neighbors don’t require a translator (75% of Belizeans speak English fluently (Belize Residential Property Market Analysis 2024)). Many retirees also appreciate that Belize, as a former British colony, has familiar legal and political systems (Common Law, etc.), which makes processes like property purchase or setting up utilities more straightforward than in some other expat havens. Additionally, safety in Hopkins is generally good – it’s a small community where people know each other. Typical precautions apply (locking up your home, not leaving valuables in plain sight), but violent crime is extremely rare in the village. Retirees often comment on feeling safer in Hopkins than in their former cities. Of course, integrating respectfully with the local community is important; those who embrace the local culture find they are warmly welcomed.

- Retirement Incentives and Practicalities: The Belize government actively encourages foreigners to retire in Belize through the Qualified Retirement Program (QRP). Under the QRP, eligible individuals (age 45 and older, with a proven income of $2,000 USD/month from pension or investment) can obtain residency status and enjoy special benefits (The Belize Real Estate Market in 2018 | Buy Belize) (The Belize Real Estate Market in 2018 | Buy Belize). Notably, QRP members pay no tax on foreign-sourced income, and they can import personal effects (including a car, boat, etc.) duty-free (The Belize Real Estate Market in 2018 | Buy Belize). This can be a significant savings when moving. Hopkins retirees under QRP have taken advantage of importing vehicles for getting around (though the village itself is easily walkable/bikeable). Healthcare is another practical consideration: Belize’s healthcare is affordable, but public clinics in villages are basic. Hopkins has a local polyclinic for minor ailments, while more comprehensive medical facilities (including private clinics and hospitals) are in Dangriga (30 minutes away) and Belize City (2.5 hours away). Many expats also travel to Mexico (Chetumal) or back to their home country for major medical procedures. It’s wise for retirees to budget for private health insurance or out-of-pocket medical travel, given that Medicare or other foreign insurance typically won’t cover you in Belize. That said, day-to-day healthcare costs (doctor visits, prescriptions) are low, and many common medications are available over-the-counter.

- Cost of Living: A big reason for choosing Belize is that your retirement dollars can stretch further. While Hopkins is a bit more expensive than mainland villages due to its remoteness (some goods are imported or trucked in), it’s still much cheaper than living in the U.S. or Canada. Property taxes are so low as to be almost negligible (often <$300/year for a home (Hopkins Village, Belize | What do I need to know when buying property in Hopkins Village? | Expat Exchange)). There is no tax on foreign retirement income, which means your pension, Social Security, or investment income comes to you gross. Services like housekeeping, gardening, or home maintenance are very affordable due to lower labor costs, allowing retirees a comfortable lifestyle with some hired help. Groceries can be inexpensive if you buy local produce and fish (a pound of fresh fish might be $2–3). Imported goods (cheese, certain electronics) will cost more due to import duties. Many expats say they live better in Belize on half the monthly budget they needed in North America. As of 2025, a couple could live in Hopkins on perhaps $2,000–$3,000 USD per month modestly, or $3,000–$4,000+ for a more upscale lifestyle (dining out frequently, maintaining a car, etc.). This cost advantage is a major lifestyle benefit.

- Lifestyle Adjustments: Those moving to Hopkins for retirement should be prepared for some adjustments. Infrastructure, while improved, is not like back home. Roads can be potholed (the road into Hopkins was only recently paved in parts, and some internal village streets are still dirt/gravel). Power and water are generally reliable, but occasional outages happen, as do slower repair times for utilities. The convenience of big-box shopping is absent – instead, you’ll do your marketing at small shops or by driving to Dangriga for larger supermarkets. Patience and flexibility are key traits for a happy life in Belize; things move on “Belize time,” which is to say, a bit slower and more laid-back. Many retirees, however, come to embrace this change of pace as part of the charm. It’s also recommended to rent before buying if possible – spending a few months in Hopkins in different seasons can ensure the lifestyle suits you (some expats find the summer heat or isolation in off-season not to their liking, while others love the quiet). Overall, for those who value natural beauty, community, and a simple, outdoor-oriented life, Hopkins is close to ideal.

In essence, Hopkins offers a lifestyle that is the epitome of “tropical easy living.” You can wake up to sea breezes, fill your days with fulfilling activities (or none at all, with no pressure), and know your neighbors by name. The fact that this lifestyle can be attained at a fraction of the cost of coastal living in the U.S. is the icing on the cake. Retirement in Hopkins is not just about where you live, but how you live – and for many, the balance of relaxation and adventure found here is exactly what they dreamed of. Belize’s supportive policies (QRP, no property restrictions) make it straightforward to make that dream a reality (Belize Residential Property Market Analysis 2024) (Belize Residential Property Market Analysis 2024).

Conclusion

The Hopkins, Belize real estate market has transformed significantly from 2015 to 2025, evolving from a quiet secret into a burgeoning hotspot for both investment and retirement. Historically, property prices near the beach have seen strong appreciation, driven by growing international demand, a booming tourism scene, and the allure of Belize’s affordable, English-speaking paradise (The Belize Real Estate Market in 2018 | Buy Belize) (Belizean Real Estate Market Trends and Mortgage Rates – Hopkins Belize Travel). Supply has expanded with new developments, yet demand has often outpaced it, especially for prime beachfront land, leading to higher prices and a “seller’s market” environment in recent years.

Looking forward to 2025–2035, the outlook is one of cautious optimism. All signs point to continued growth – Belize’s tourism is set to reach new heights and Hopkins is on the cusp of broader recognition as both a travel destination and a retirement haven. We project that property values will continue to grow annually (supported by strong fundamentals), new opportunities will arise (in rental investments and niche developments), and the area will further mature in terms of amenities and infrastructure. However, this growth will likely remain sustainable and measured, as Hopkins retains its small-village charm and as stakeholders manage risks like weather and ethical development practices. Potential risks, from hurricanes to past real estate scams, serve as reminders that due diligence and prudent planning are essential for anyone entering the market – but they are factors that can be mitigated with knowledge and preparation (Belize Residential Property Market Analysis 2024) (FTC Sending Refunds to Consumers who Invested in Deceptive Sanctuary Belize Real Estate Development Scheme Operated by Repeat Offender Andris Pukke | Federal Trade Commission).

For investors, Hopkins represents a chance to get in on a market that still has “untapped potential” but is clearly on an upward trajectory (Belize Real Estate: Invest in a Growing Market with Untapped Potential). High rental yields, rising property values, and a friendly investment climate (no capital gains tax, full foreign ownership rights) create a compelling value proposition. For retirees and lifestyle buyers, the value is not just monetary but deeply personal – it’s about claiming a slice of Caribbean beachfront and embracing a fulfilling, laid-back lifestyle in a community that welcomes you. Programs like Belize’s QRP make it easier than ever to retire comfortably under the palm trees (The Belize Real Estate Market in 2018 | Buy Belize).

In crafting this report, we referenced local real estate agencies, development announcements, government data, and international market analyses to ensure a well-rounded perspective. The accompanying charts and tables visualized key points: a steady climb in prices, significant milestones in development, and the intersection of market forces and lifestyle factors that define Hopkins real estate. The data and anecdotes all tell a similar story – one of a small beach town on the rise, yet determined to preserve the natural and cultural treasures that made it special in the first place.

Whether one is seeking an investment with solid returns, a retirement haven by the sea, or a bit of both, Hopkins stands out as a unique opportunity in the global real estate landscape. As with any market, careful research and local guidance are recommended, but the trends of the past decade and the projections for the next paint an encouraging picture. In Hopkins, Belize, the gentle crash of waves on the shore is more than just a backdrop – it’s the soundtrack to both a smart investment and a peaceful life.